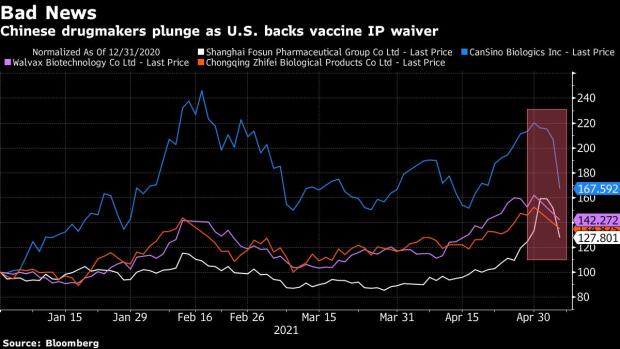

U.S. support for a proposal to waive intellectual-property protections for Covid-19 vaccines might be good news for the global inoculation campaign, but it’s an unwelcome turn for firms whose share prices have been buoyed by profits from coronavirus shots.

Pfizer Inc., BioNTech SE, Novavax Inc. and CureVac NV declined Thursday in U.S. premarket trading. Shanghai Fosun Pharmaceutical Group Co., which has the rights to develop and market BioNTech’s shot in China, plunged 14% in Hong Kong, the most ever.

With many countries struggling with a resurgence of the virus, U.S. Trade Representative Katherine Tai said Wednesday the Biden administration will take part in negotiations for the text of a waiver of the rights at the World Trade Organization. The European Union said Thursday it was willing to participate.

CanSino Biologics Inc., which makes one of China’s domestic vaccines, tanked 15%. Walvax Biotechnology Co. dropped 11% and Chongqing Zhifei Biological Products Co. fell 8.7%, dragging the CSI 300 Index’s healthcare gauge more than 5% lower.

In Japan, JCR Pharmaceuticals Co., a local partner for AstraZeneca Plc’s vaccine, slid 1.4% even as positive news around inoculations in western economies helped boost the benchmark Topix index 1.5% higher.

Vaccines have been a big business for the firms that make them, with Pfizer, BioNTech’s partner outside of China, raising its forecast for 2021 vaccine sales to $26 billion just this week. Pfizer slipped 3.4% in premarket trading, while BioNTech slumped 7.3%, Novavax lost 2.8%, Curevac slipped 4.9% and Moderna Inc. fell 1.7%. Shares of many of the U.S.-listed companies had fallen late in Wednesday’s regular trading session after Tai’s comments.

The U.S. move “probably isn’t great news for the vaccine manufacturers who will now face generic copies of their vaccine, but as the mutation of the virus has shown, continued research and innovation will be needed and that should provide those companies with future earnings from newer vaccines so I would expect the impact to be short-lived and possibly limited,” said Olivier d’Assier, head of APAC applied research at Qontigo GmbH.

The International Federation of Pharmaceutical Manufacturers & Associations condemned the move as “disappointing.”

“A waiver is the simple but the wrong answer to what is a complex problem,” the group said in a statement. “Waiving patents of Covid-19 vaccines will not increase production nor provide practical solutions needed to battle this global health crisis.”

Umer Raffat, a senior managing director at Evercore ISI who specializes in the pharmaceutical industry, urged caution on the news, noting U.S. support didn’t mean it was a “100% done deal” as other countries are also opposed. It “remains to be seen if U.S. leadership’s position sways others,” Ruffat wrote in a note.

Dear Reader,

Dear Reader,

Business Standard has always strived hard to provide up-to-date information and commentary on developments that are of interest to you and have wider political and economic implications for the country and the world. Your encouragement and constant feedback on how to improve our offering have only made our resolve and commitment to these ideals stronger. Even during these difficult times arising out of Covid-19, we continue to remain committed to keeping you informed and updated with credible news, authoritative views and incisive commentary on topical issues of relevance.

We, however, have a request.

As we battle the economic impact of the pandemic, we need your support even more, so that we can continue to offer you more quality content. Our subscription model has seen an encouraging response from many of you, who have subscribed to our online content. More subscription to our online content can only help us achieve the goals of offering you even better and more relevant content. We believe in free, fair and credible journalism. Your support through more subscriptions can help us practise the journalism to which we are committed.

Support quality journalism and subscribe to Business Standard.

Digital Editor

More Stories

Makes sense to remain constructive on equities: Nimesh Shah of ICICI Pru MF

ACME joins hand with UNSOPS & IFU for 250 MW solar project

Top 5 Indian IT compannies to add over 96,000 employees: Nasscom