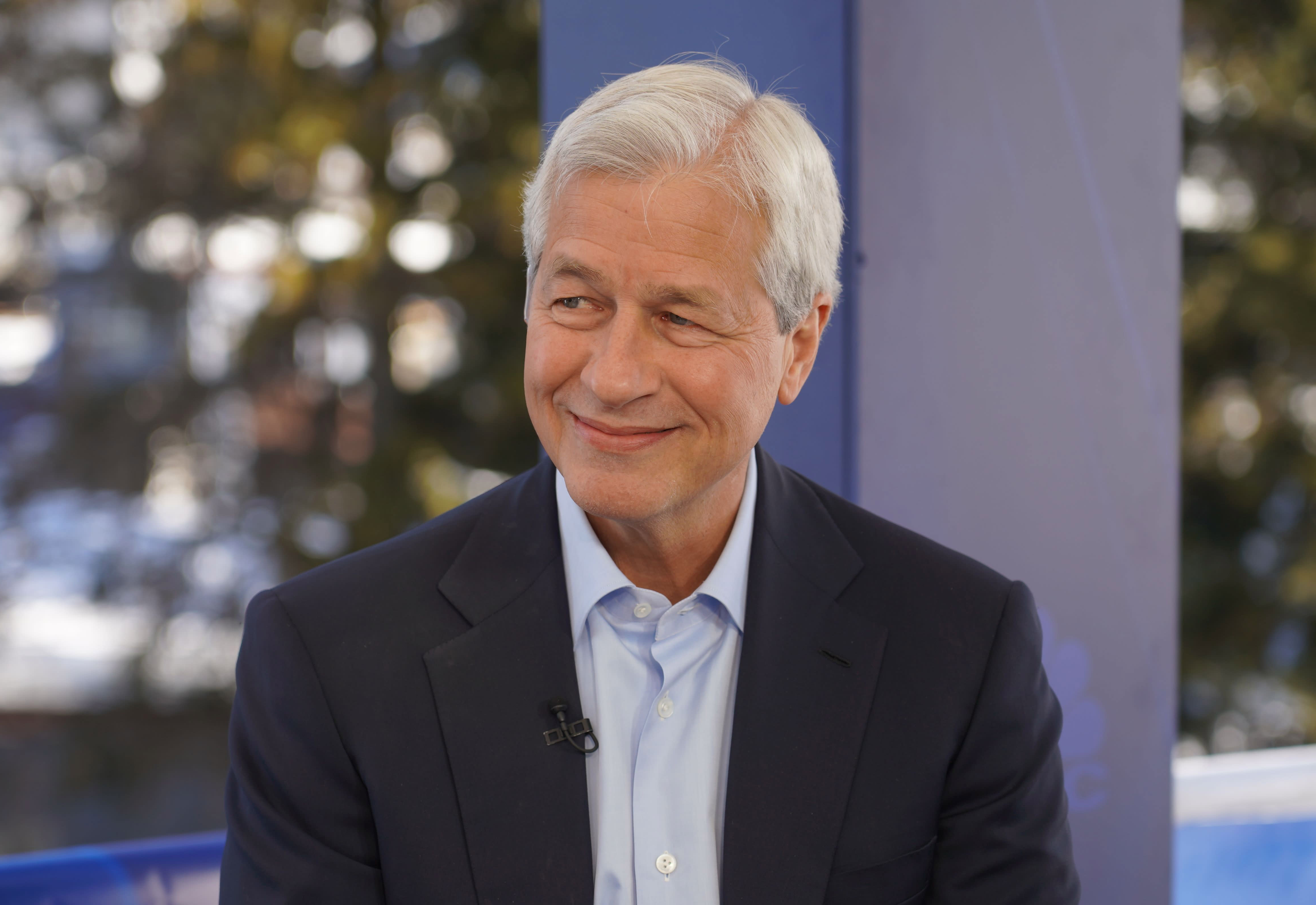

Jamie Dimon, CEO of JP Morgan Chase, appears on CNBC’s Squawk Box at the 2020 World Economic Forum in Davos, Switzerland on Jan. 22nd, 2020.

Adam Galica | CNBC

JPMorgan Chase CEO Jamie Dimon has watched while a new breed of fintech players, led by PayPal, Square and tech giants around the world including e-commerce giant Alibaba have skyrocketed in users and market cap.

His message to the management team of his $3.4 trillion banking goliath: Be frightened.

“Absolutely, we should be scared s—less about that,” Dimon said Friday in a conference call with analysts. “We have plenty of resources, a lot of very smart people. We’ve just got to get quicker, better, faster… As you look at what we’ve done, you’d say we’ve done a good job, but the other people have done a good job too.”

Dimon’s blunt assessment was in response to questioning from analysts including Mike Mayo of Wells Fargo who pointed out that with rich, tech-like valuations, fintech players have “trounced” the traditional banks in recent years.

Dimon said that he sent his deputies a list of global competitors, and that PayPal, Square, Stripe, Ant Financial as well as U.S. tech giants including Amazon, Apple and Google were names the bank needs to keep an eye on. The rivals are also clients of the firm’s commercial and investment banking in many cases, he added.

Competition will be particularly tight in the world of payments, he noted: “I expect to see very, very tough, brutal competition in the next ten years,” Dimon said. “I expect to win, so help me God.”

Dimon added that in some cases, the new players were “examples of unfair competition” that the bank would do something about eventually. He included players that take advantage of richer debit-card revenue for small banks and firms Dimon accused of not doing proper anti-money laundering precautions.

He specifically called out Plaid, the payments start-up whose acquisition by Visa recently collapsed:

“People who improperly use data that’s been given to them, like Plaid.”

Plaid CEO Zach Perrett declined to directly respond to the accusation during an interview with CNBC’s David Faber, adding that Plaid is spending time with the bank on a partnership.

With contributions from CNBC’s Dawn Giel

More Stories

Fintech firm Klarna is raising $1 billion at a $31 billion valuation, sources say

SBI, Shapoorji Pallonji sign MoU to offer faster home loan approvals

Upbeat on prospects in rural market, DCB Bank focuses on tractor loans